Recent News

Read the latest news and stories.

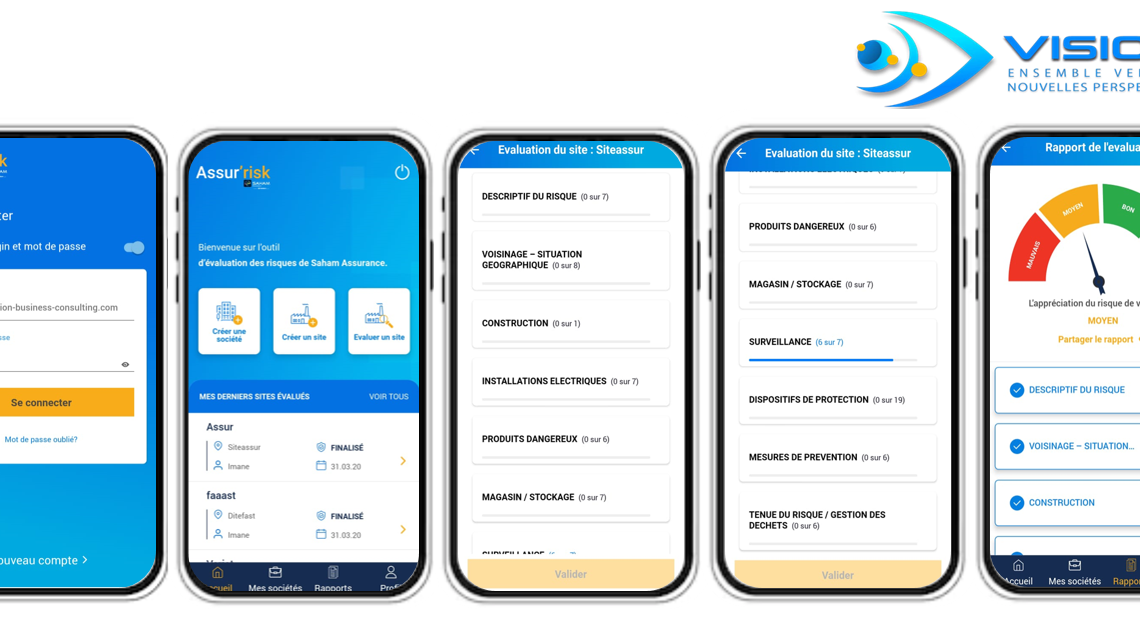

Mobile App Assur’Risk for SAHAM

ABOUT THE CLIENT

Saham Assurance is one of the main Moroccan insurance companies with subsidiaries in 14 African countries, they offer life and non-life products

PROJECT OVERVIEW

This is the first application of its kind in Morocco. The application enables corporate and individual insurance customers to simulate their exposure to fire risk, and then calculate a risk score.

TECHNICAL DIFFICULTIES

We carried out the development of the mobile application, from upstream strategic thinking through to deployment, production and maintenance, including the drafting of detailed functional specifications, development and testing, not forgetting assistance with deployment and change management.

THE SOLUTION

The application includes a .Net back-office for configuring questionnaires and their weights, and Dashboard reporting. It also includes algorithms for calculating estimated insurance premiums, and two applications (IOS and Android) for rolling out questionnaires and arriving at compliance rates.

KEY BENEFITS

Transparency for policyholders: Policyholders benefit from greater transparency in the pricing of their insurance policy. They better understand how their premium is calculated, and can take steps to reduce their fire risk, which can translate into lower premiums.

Encouraging prevention: Policyholders can be encouraged to implement fire prevention measures, such as installing fire detection systems, sprinklers, etc., to reduce their fire risk score and, consequently, their insurance premium.

Adaptability to changes in risk: Fire risk scores can be regularly updated to reflect changes in the environment, location, building characteristics, etc. This ensures that the insurance premium is kept low. This ensures that the insurance premium remains aligned with the current level of risk.

TECHNOLOGY

.Net

Postman

API Rest

React Native